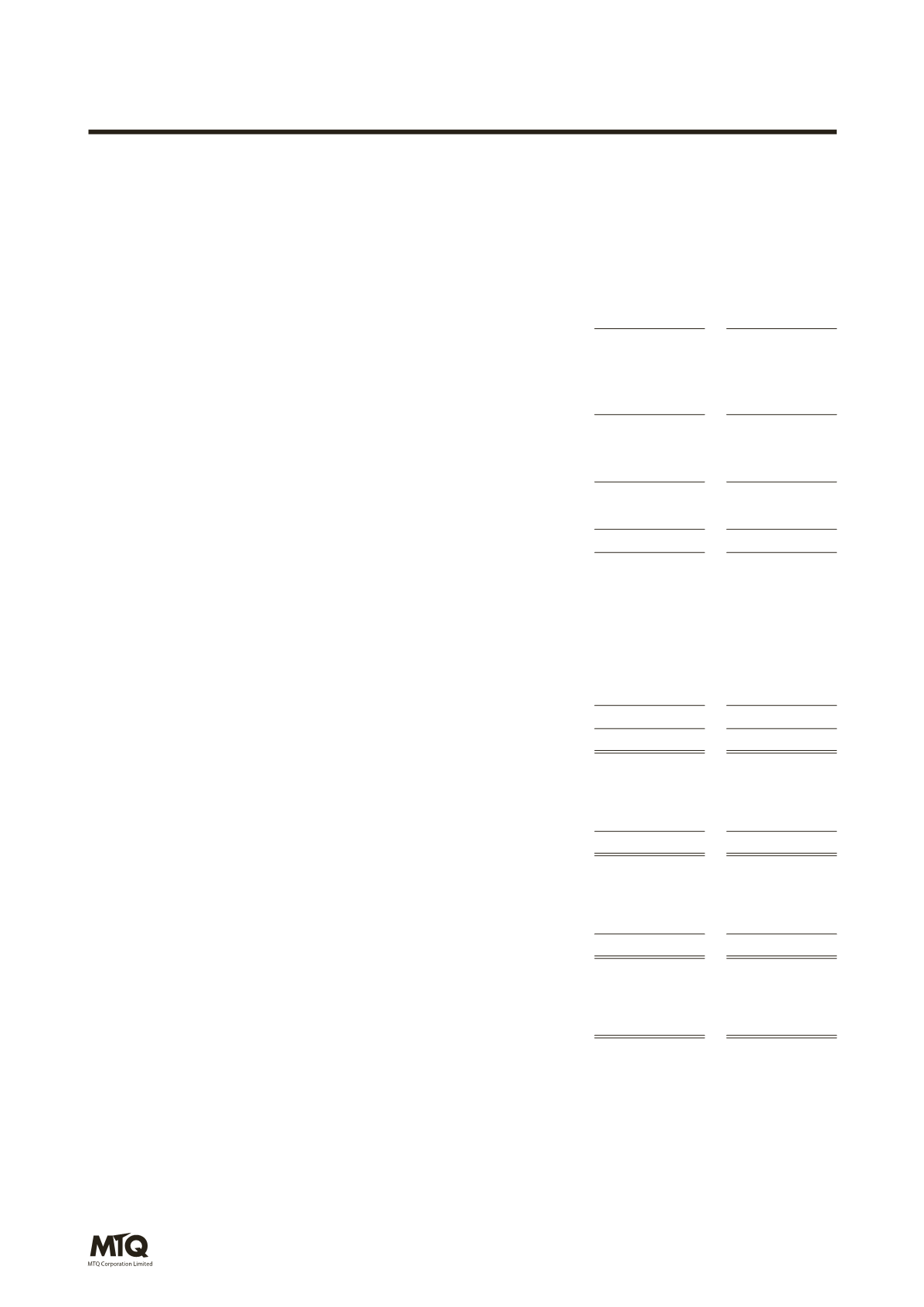

40

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

For the financial year ended 31 March 2015

(In Singapore dollars)

Note

2015

$’000

2014

$’000

(Restated)

Revenue

3

295,640

313,330

Cost of sales

(202,976)

(209,522)

Gross profit

92,664

103,808

Other income

4

1,280

2,187

Staff costs

(46,227)

(44,525)

Other operating expenses

(35,108)

(28,754)

Profit from operating activities

5

12,609

32,716

Finance costs

6

(2,405)

(2,910)

Share of results of a joint venture company

(1,027)

105

Profit before taxation

9,177

29,911

Taxation

7

(3,703)

(5,261)

Profit for the financial year, net of tax

5,474

24,650

Other comprehensive income/(loss):

Items that may be reclassified subsequently to profit or loss:

Exchange difference on translation of subsidiaries

(7,035)

(5,435)

Net gain on hedge of net investment in foreign operation

3,540

3,929

Net fair value of loss on derivatives

(76)

–

Foreign currency reserve reclassified to profit or loss upon liquidation of

a subsidiary

–

(219)

Other comprehensive loss for the financial year, net of tax

(3,571)

(1,725)

Total comprehensive income for the financial year

1,903

22,925

Profit for the financial year attributable to:

Owners of the Company

5,021

23,878

Non-controlling interests

453

772

5,474

24,650

Total comprehensive income attributable to:

Owners of the Company

1,902

22,609

Non-controlling interests

1

316

1,903

22,925

Earnings per share attributable to owners of the Company

– Basic

8 3.27 cents

15.80 cents

– Diluted

8 3.26 cents

15.79 cents

The accompanying accounting policies and explanatory notes form an integral part of the financial statements.