4

ANNUAL REPORT 2015/2016

BUSINESS REVIEW

A COMPETITIVE LANDSCAPE

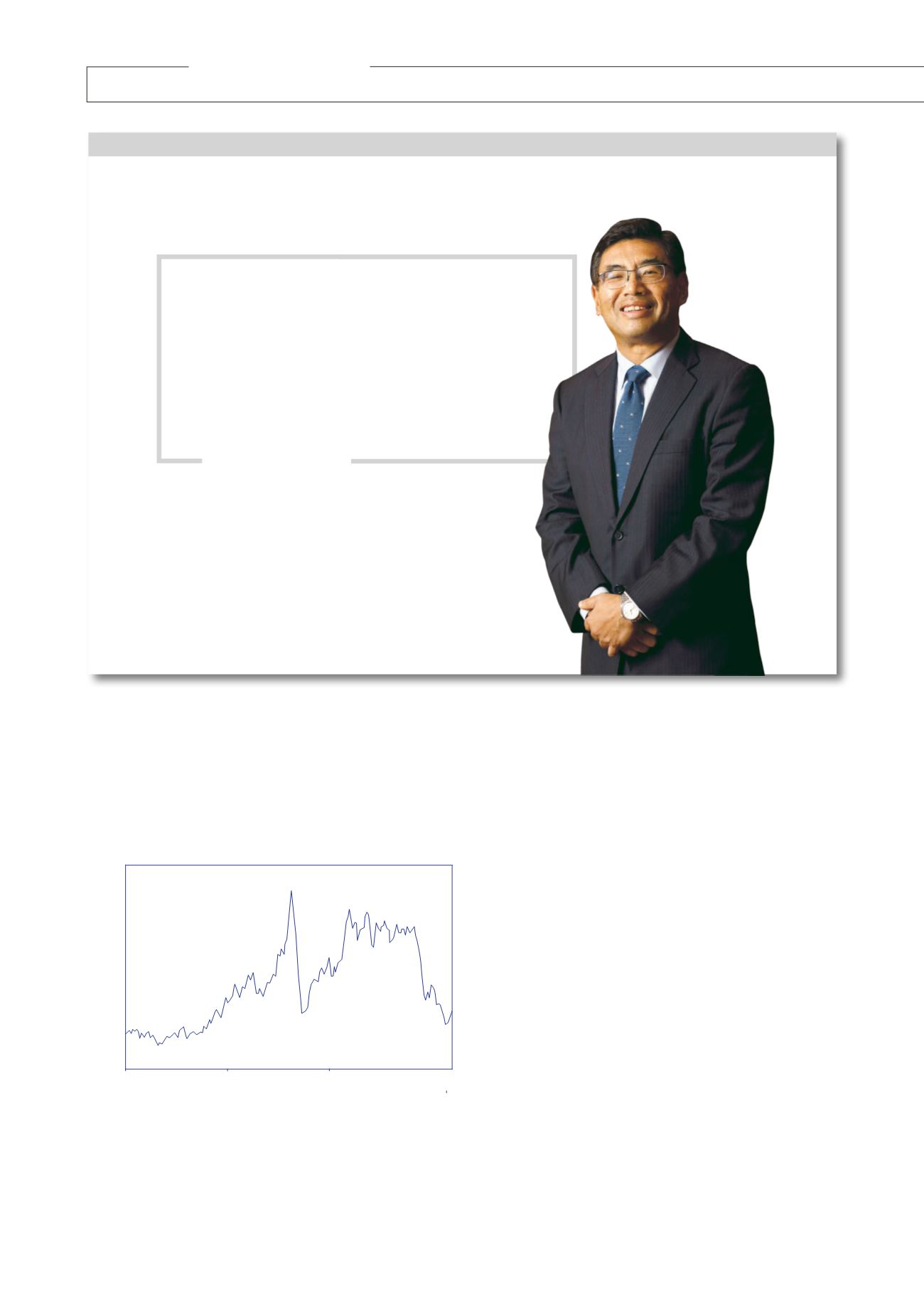

The year has seen oil prices remain depressed and there

is growing realization that recovery while a certainty

is not imminent. Physical demand for fossil fuels

has remained steadily growing and inelastic despite

price movements but supply only started to recede in

mid-2015 with storage demand still strong globally.

Middle Eastern and Russian production has remained

consistent with Iran poised to recover some lost market

share while shale output continues to fall. International

oil companies have continued to make significant cuts

to capital expenditure into 2016 and beyond. The bulk

of these cuts will be felt this year. Within Australia,

mega projects like Gorgon and Ichthys are starting the

process of adding LNG supply to the global marketplace

but projects on the drawing board like Browse have

been delayed and will remain on the backburner till the

supply situation improves.

Another theme prevalent in our industry is that of

consolidation. We have seen Shell completed the

acquisition of BG Group in February and Schlumberger

completing its merger with Cameron in April 2016.

Technip and FMC have announced their intention

to merge. Such consolidation within every segment

GROUP CEO’S

STATEMENT

May

2016

May

2000

May

2005

May

2010

160 -

140 -

120 -

100 -

80 -

60 -

40 -

20 -

0 -

Crude Oil Price (USD/bbl)

CRUDE OIL PRICE

Kuah Boon Wee

Group Chief Executive Officer

“Inthemeantime,ourbusinesseswill

focus on the opportunities available,

raising utilization, developing new

capabilites, preserving cash....”