Investor Relations - Financials

Investor Relations - Financials

Unaudited Condensed Interim Financial Statements For The Six-Month Financial Period Ended 30 September 2025

Financials Archive![]() Note: Files are in Adobe (PDF) format.

Note: Files are in Adobe (PDF) format.

Please download the free Adobe Acrobat Reader to view these documents.

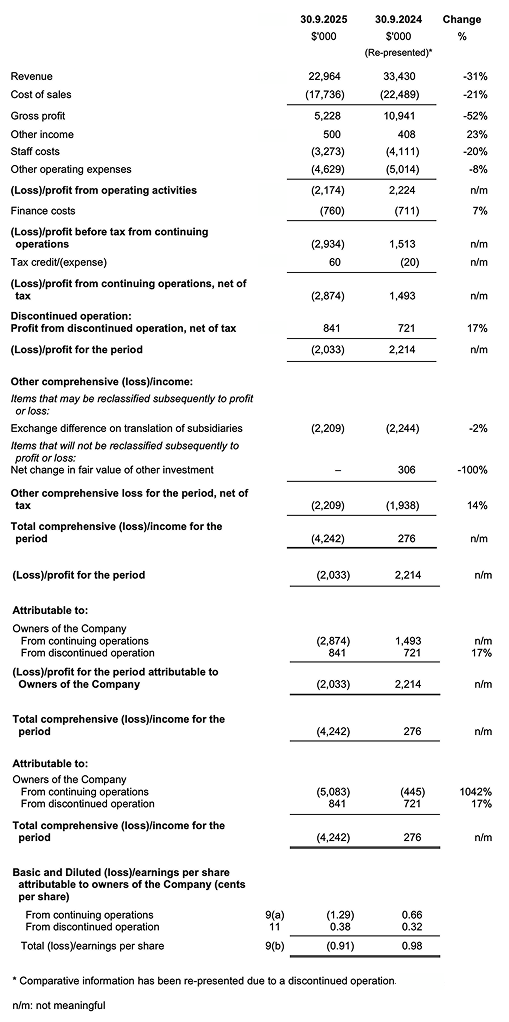

Condensed interim consolidated statement of comprehensive income For the six-month financial period ended 30 September 2025

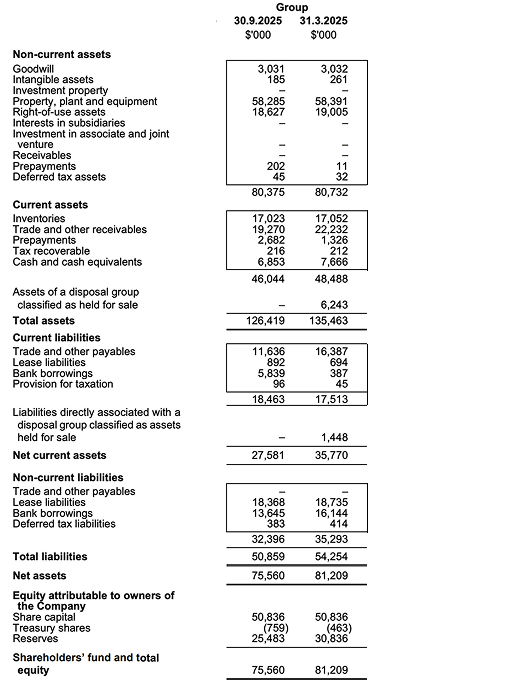

Condensed interim balance sheets As at 30 September 2025

REVIEW OF GROUP PERFORMANCE

Condensed Interim Balance Sheets

The changes in most balance sheet lines were mainly due to:

- completion of disposal of assets held for sale and liabilities directly associated with the assets held for sale;

- increase in bank borrowings and the reclassification of S$5.7 million bank borrowings from non-current to current liabilities; and

- payment of S$1.1 million dividends in respect of previous financial year;

Apart from the above, the change in net assets was mainly due to the total comprehensive loss of S$4.2 million, and changes in working capital items were mainly due to timing differences.

Condensed Interim Consolidated Cash Flow Statement

The Group recorded net cash outflows of S$0.2 million from operations in 1HFY2026. Investing activities mainly comprised capital expenditure of approximately S$5.0 million related to the Group's expansion into the UAE, and proceeds of about S$3.8 million received from the disposal of Pemac. After accounting for a net drawdown of S$3.0 million in bank borrowings and the payment of FY2025's final dividend of S$1.1 million, the Group ended the period with cash and cash equivalents of S$6.9 million as at 30 September 2025 (31 March 2025: S$7.7 million).

Condensed Interim Consolidated Statement of Comprehensive Income

The Group reported S$23.0 million revenue for 1HFY2026, a decrease of 31% year-on-year ("YOY") compared to S$33.4 million in 1HFY2025, largely attributable to weaker performance from Bahrain, reflecting continued market softness and volatility in Saudi Arabia and Bahrain. Revenue in Singapore was also lower compared to 1HFY2025, mainly due to timing factors and reduced contributions from the trading business, though underlying activity levels remained relatively healthy. Correspondingly, the Group's gross profit margin declined to 22.8% (from 32.7% in 1HFY2025), primarily due to lower utilization during the period.

For 1HFY2026, the Group also recorded higher UAE-related pre-operating expenses amounting to approximately S$1.9 million (of which about S$0.9 million were recognized within staff costs and other operating expenses), in line with the ramp-up of its new operations in the region. Despite these, total staff costs and other operating expenses were lower compared to 1HFY2025 reflecting the Group's continued cost discipline through tighter control and regular revalidation of major expenditure areas. Finance costs, however, increased in line with higher borrowings during the period.

Profit from discontinued operation comprised the gain on disposal of Pemac, following the completion of the transaction on 14 April 2025.

Overall, the Group's reported a net loss after tax of S$2.0 million in 1HFY2026, compared to a profit of S$2.2 million in 1HFY2025.

Commentary

The first half of FY2026 has been challenging for the Group, particularly for the Bahrain operations, which continued to experience slower order conversion amid ongoing market uncertainties in Saudi Arabia and Bahrain. In Singapore, revenue was lower, though underlying business activity has remained relatively stable.

The Group's new UAE facility is now operational, with initial key industrial certifications obtained and further qualifications underway to strengthen its customer base in the region. The Group has also started completing some initial work, with additional orders secured and scheduled in the coming months as it gradually builds momentum.