122

NOTES TO THE FINANCIAL STATEMENTS

For the financial year ended 31 March 2015

(In Singapore dollars)

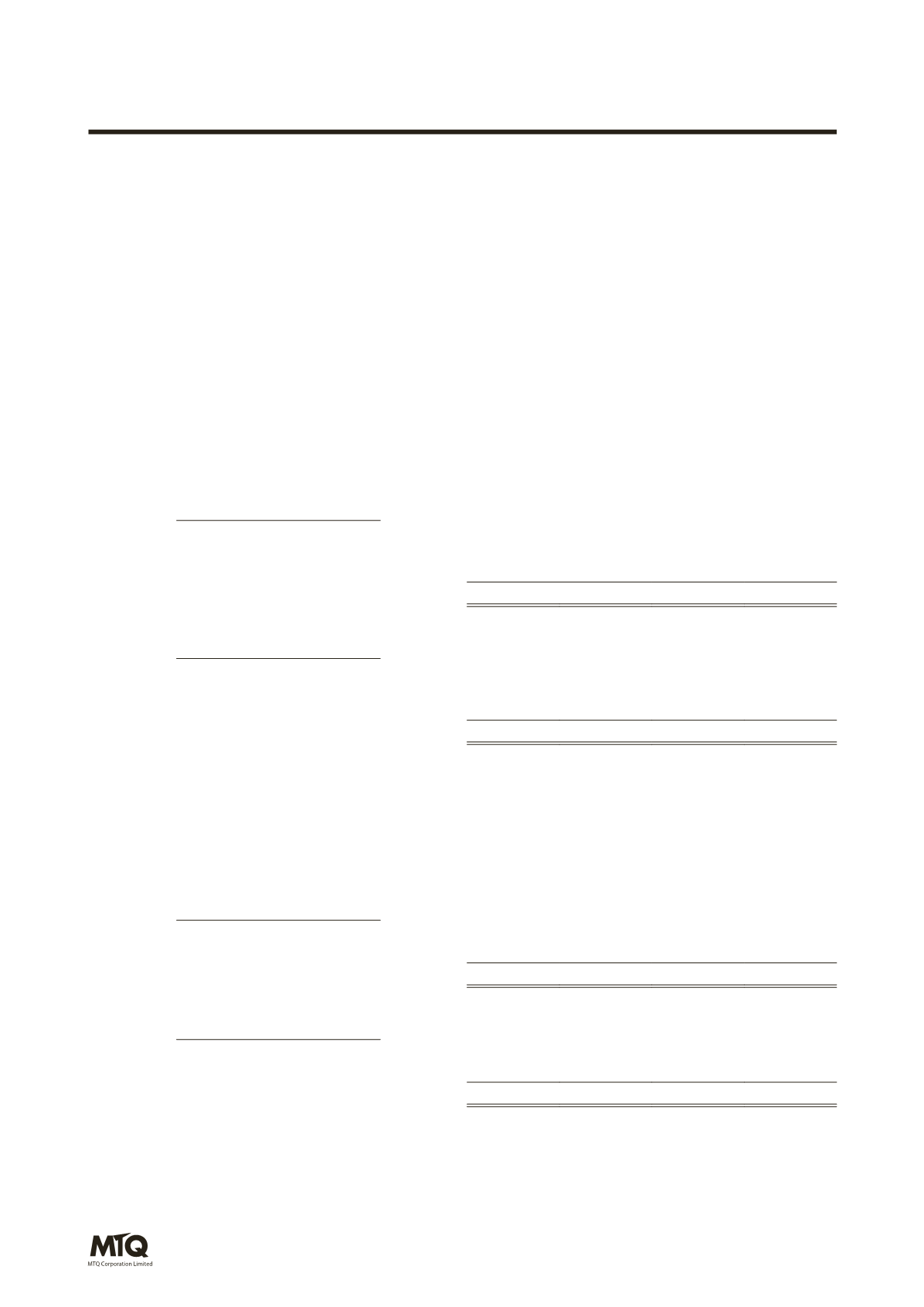

32. FINANCIAL RISK MANAGEMENT OBJECTIVES AND POLICIES (CONT’D)

(c)

Liquidity risk (cont'd)

Analysis of financial instruments by remaining contractual maturities

The tables below summarises the maturity profile of the Group’s and the Company’s financial liabilities at

the end of the reporting period, based on contractual undiscounted repayment obligations:

Total

contractual

cash flow

$’000

1 year

or less

$’000

1 to 5 years

$’000

More than

5 years

$’000

Group

2015

Non-derivative financial liabilities

Trade and other payables

(44,460)

(44,460)

–

–

Bank borrowings

(64,520)

(8,993)

(50,135)

(5,392)

Finance lease payable

(839)

(485)

(354)

–

Contractual undiscounted financial liabilities

(109,819)

(53,938)

(50,489)

(5,392)

2014

Non-derivative financial liabilities

Trade and other payables

(54,203)

(49,605)

(4,598)

–

Bank borrowings

(71,246)

(8,884)

(56,386)

(5,976)

Finance lease payable

(1,447)

(862)

(585)

–

Contractual undiscounted financial liabilities

(126,896)

(59,351)

(61,569)

(5,976)

Total

contractual

cash flow

$’000

1 year

or less

$’000

1 to 5 years

$’000

More than

5 years

$’000

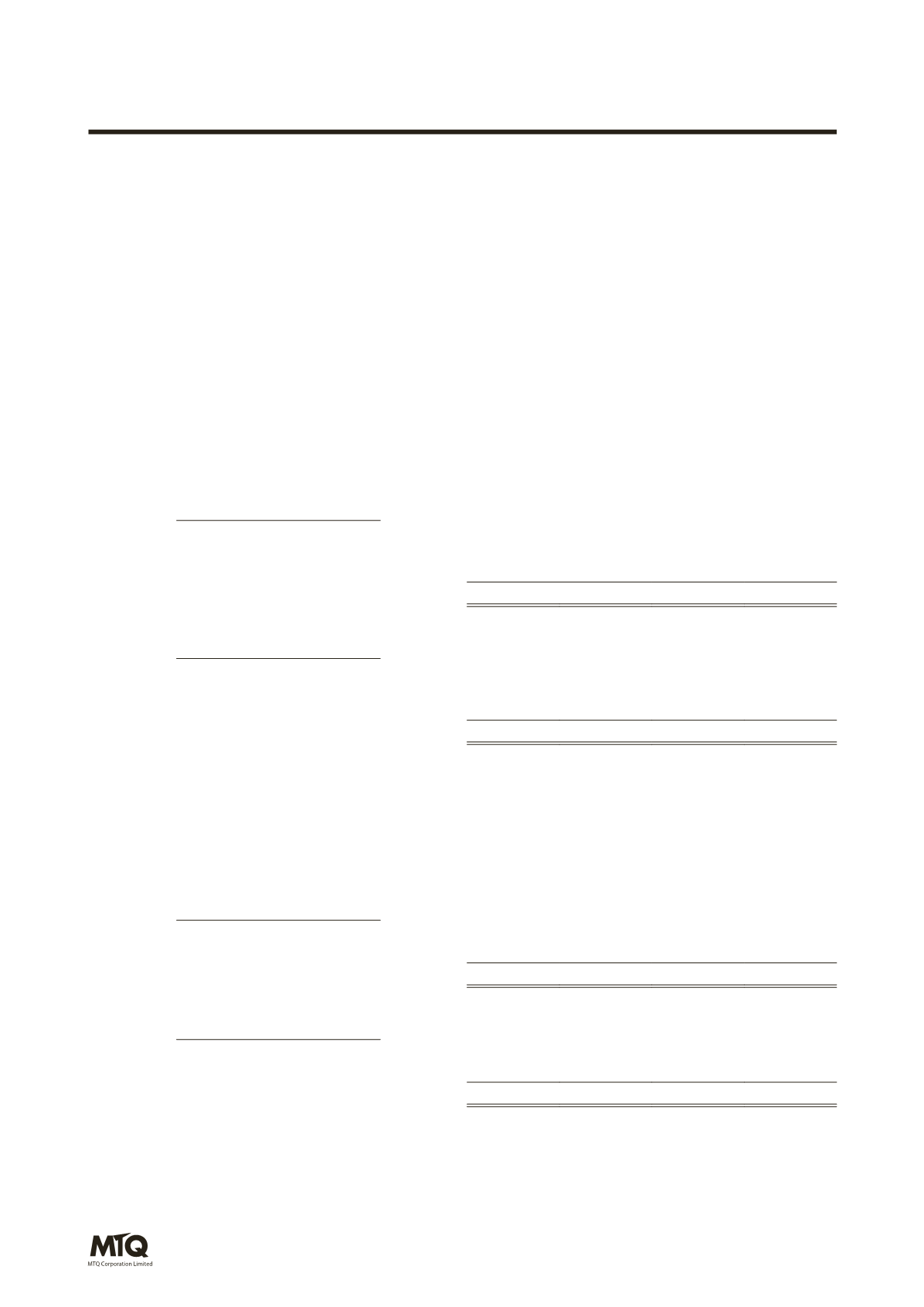

Company

2015

Non-derivative financial liabilities

Trade and other payables

(8,696)

(2,457)

–

(6,239)

Bank borrowings

(14,133)

(4,082)

(4,659)

(5,392)

Contractual undiscounted financial liabilities

(22,829)

(6,539)

(4,659)

(11,631)

2014

Non-derivative financial liabilities

Trade and other payables

(9,841)

(3,594)

–

(6,247)

Bank borrowings

(16,733)

(3,802)

(6,955)

(5,976)

Contractual undiscounted financial liabilities

(26,574)

(7,396)

(6,955)

(12,223)