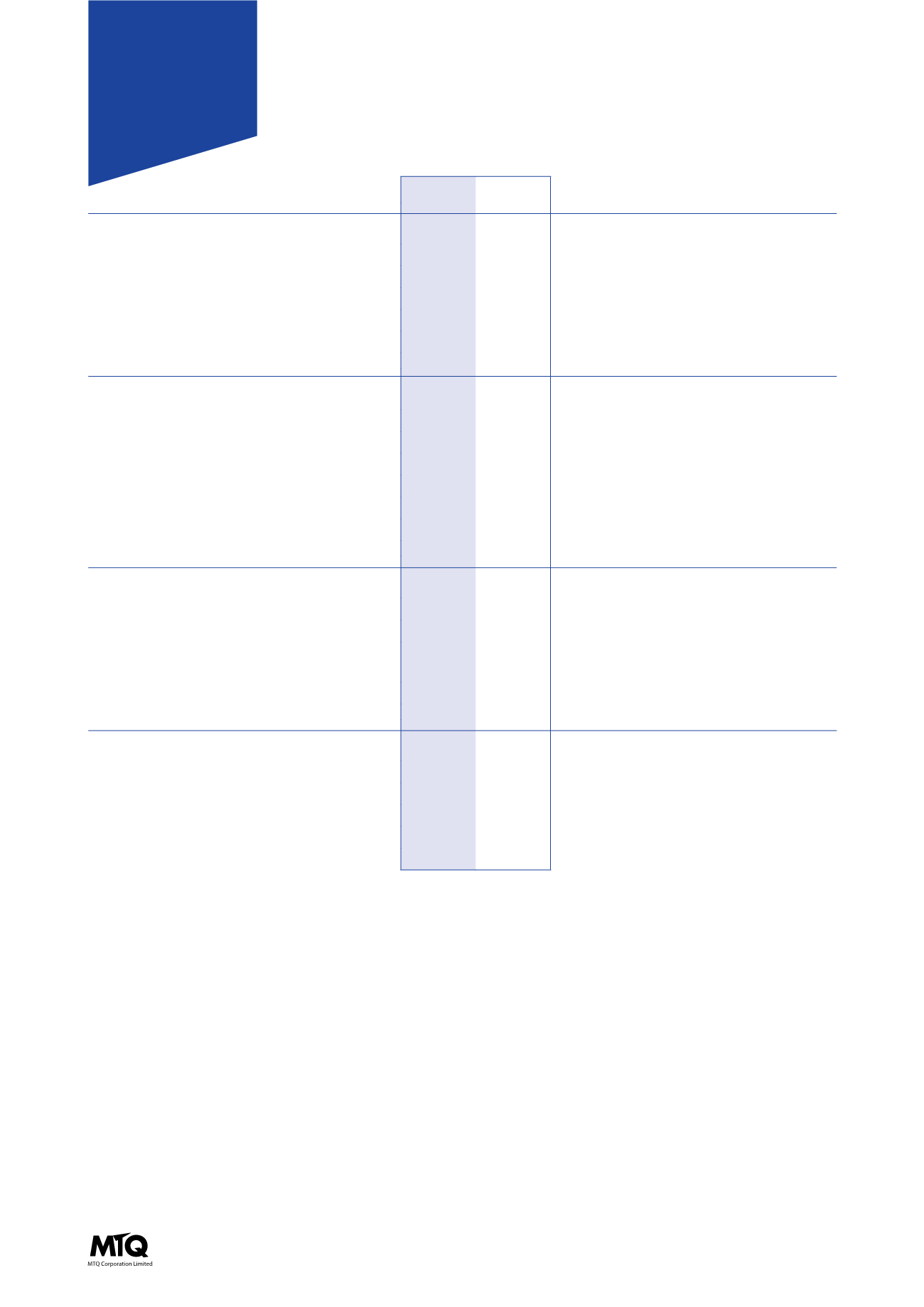

2015 2015

1

2014 2013 2012 2011

For the year (in S$’000)

Revenue

295,640 295,640 313,330 208,746 128,395 91,714

EBITDA

24,259 31,087 43,297 30,603 21,068 17,409

Profit before tax

9,177 16,005 29,911 20,642 13,898 13,318

Profit after tax

5,474 12,302 24,650 16,639 14,607 10,743

Profit attributable to owners of the Company 5,021 11,849 23,878 15,397 14,607 10,631

At year end (in S$’000)

Net current assets

82,389 82,389 83,631 85,888 26,865 37,034

Total assets

256,405 256,405 271,309 257,042 164,018 132,562

Total liabilities

118,055 118,055 130,997 136,283 77,886 54,839

Net debt

2

16,297 16,297 28,445 32,664 18,611

4,486

Shareholders' funds

128,960 128,960 130,657 110,356 86,692 78,283

Net tangible assets

3

106,920 106,920 99,119 90,927 74,274 70,574

Financial Ratios

Profit before tax margin (%)

3.10

5.41

9.55

9.89

10.82

14.52

Return on shareholders’ funds (%)

4

3.89

9.19

18.28

13.95

16.85

13.58

Interest cover (EBITDA / net interest expense)

5

10.89

times

13.95

times

16.45

times

20.44

times

22.01

times

259.84

times

Net debt gearing ratio (%)

6

10.54

10.54

16.83

21.29

17.77

5.46

Per share data

Basic earnings (in Singapore cents)

7

3.27

7.73

15.80

10.98

10.87

8.03

Net tangible assets (in Singapore cents)

8

69.19

69.19

65.03

60.52

54.85

52.85

Net asset value (in Singapore cents)

9

83.46

83.46

85.73

73.45

64.02

58.62

Dividend (in Singapore cents)

10

4.00

4.00

3.67

3.00

2.67

2.67

Dividend payout ratio (%)

11

122.32

51.75

23.23

27.32

24.56

33.25

1 The financial information in this column excluded the impact of S$6.8 million goodwill impairment to 2015’s profit or loss items.

2 Net debt is defined as gross debt less cash and bank balances.

3 Net tangible assets is defined as shareholders’ funds less intangible assets.

4 Return on shareholders’ funds is defined as profit attributable to owners of the Company divided by shareholders’ funds.

5 Net interest expense refers to interest expense less interest income.

6 Net debt gearing is defined as the ratio of net debt to net capitalisation. Net capitalisation is the aggregate of net debt and total

equity.

7 Basic earnings per share is defined as profit attributable to owners of the Company divided by weighted average number of issued

shares.

8 Net tangible assets per share is defined as net tangible assets divided by total number of issued shares excluding treasury shares,

adjusted for the effect of bonus shares issued in 2013 and 2014.

9 Net asset value is defined as shareholders’ funds divided by total number of issued shares excluding treasury shares, adjusted for the

effect of bonus shares issued in 2013 and 2014.

10 Headline dividend is 4.00 Singapore cents per share. The figures have been adjusted retrospectively for the effect of bonus shares,

which are entitled to the final dividends, issued in 2013 and 2014.

11 Dividend payout ratio is defined as dividend per share paid/payable in respect of the financial year divided by the basic earnings per

share.

12

FIVE-YEARS

FINANCIAL

PROFILE