BUSINESS REVIEW

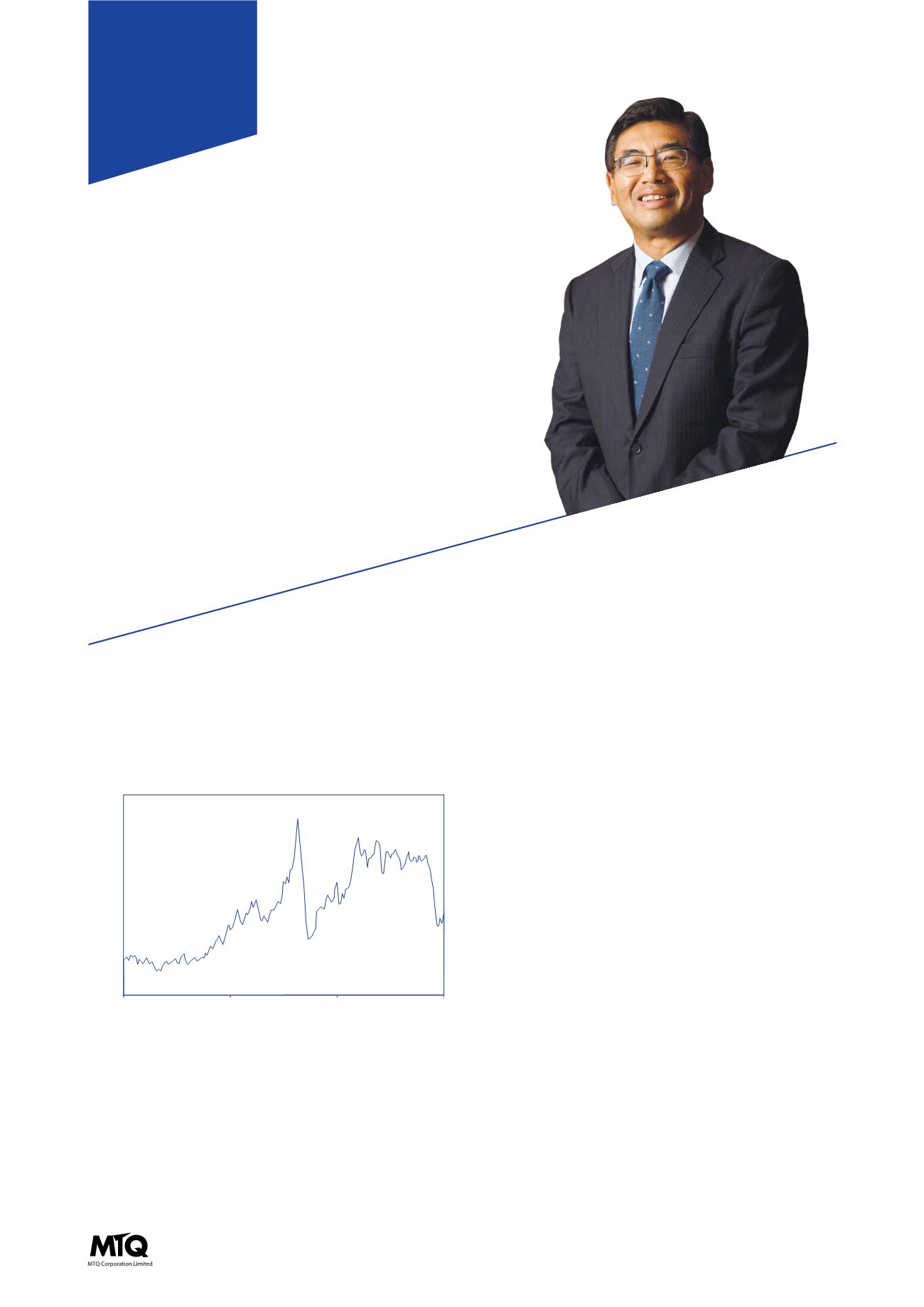

IMPACT OF OIL PRICE MOVEMENT

It would be an understatement to say that global

oil prices have been in the news since October 2014.

Physical demand for fossil fuels has remained steadily

growing and inelastic despite price movements,

indicating that the real challenge has been supply,

or more accurately, the perception of ever growing

supply. With the exception of Middle Eastern sources,

international oil companies have announced significant

cuts to capital expenditure since late 2014. Within

Australia, mega projects like Gorgon, Ichthys, Prelude

andWheatstone are due to come on stream in the next

24 months, additional developments may encounter

delays.

Rig utilisation has been dropping as lower drilling

expenditure coincides with deliveries of new drilling

assets with the predictable decline in day rates. Industry

consolidation is likely to accelerate moving ahead, we

have already seen Haliburton-Baker Hughes among oil

service companies, Shell – BG among oil majors, etc.

Order books for capital projects are being depleted as

deliveries continue.

Production activities will continue and this will provide

opportunities for service companies but lower prices will

push down prices in line with market pressure. Lower

rates for asset owners are likely to lead to reduced

service revenues.

GROUP CEO’S

STATEMENT

4

“This is a tumultuous time in the oil and gas

industry. Recovery following a long period of

expansion can be arduous. However, we have

seen peaks and troughs before. Our financial

position is strong and our gearing is low.”

Kuah Boon Wee

Group Chief Executive Officer

May

2000

May

2005

May

2010

May

2015

160 -

140 -

120 -

100 -

80 -

60 -

40 -

20 -

0 -

Crude Oil Price (USD/bbl)

CRUDE OIL PRICE