NOTES

TO THE FINANCIAL STATEMENTS

For the financial year ended 31 March 2016

(In Singapore dollars)

127

MTQ CORPORATION LIMITED

32. FINANCIAL RISK MANAGEMENT OBJECTIVES AND POLICIES (CONT’D)

(d)

Interest rate risk (cont’d)

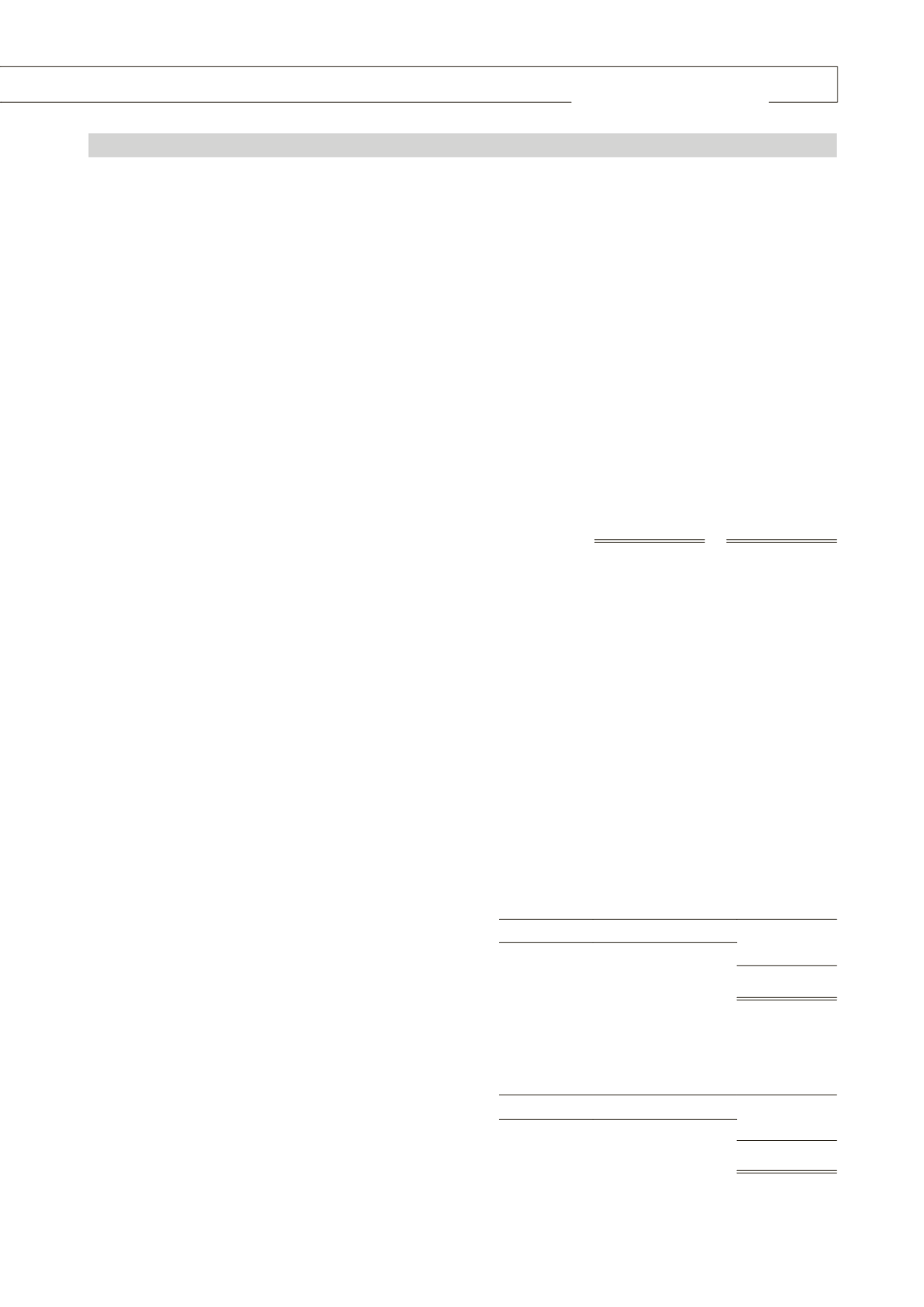

Sensitivity analysis for interest rate risk

The following table demonstrates the sensitivity of the Group’s profit before tax to a reasonably possible

change in the interest rates, with all other variables held constant:

Effect on Group’s profit

before tax

2016

$’000

2015

$’000

50 basis points increase (2015: 50 basis points increase)

(218)

(298)

50 basis points decrease (2015: 50 basis points decrease)

218

298

Information relating to the Group’s interest rate exposure is also disclosed in the notes on the Group’s cash

and cash equivalents, bank borrowings and finance lease payable where applicable. The assumed movement

in basis points for interest rate sensitivity analysis is based on the currently observable market environment.

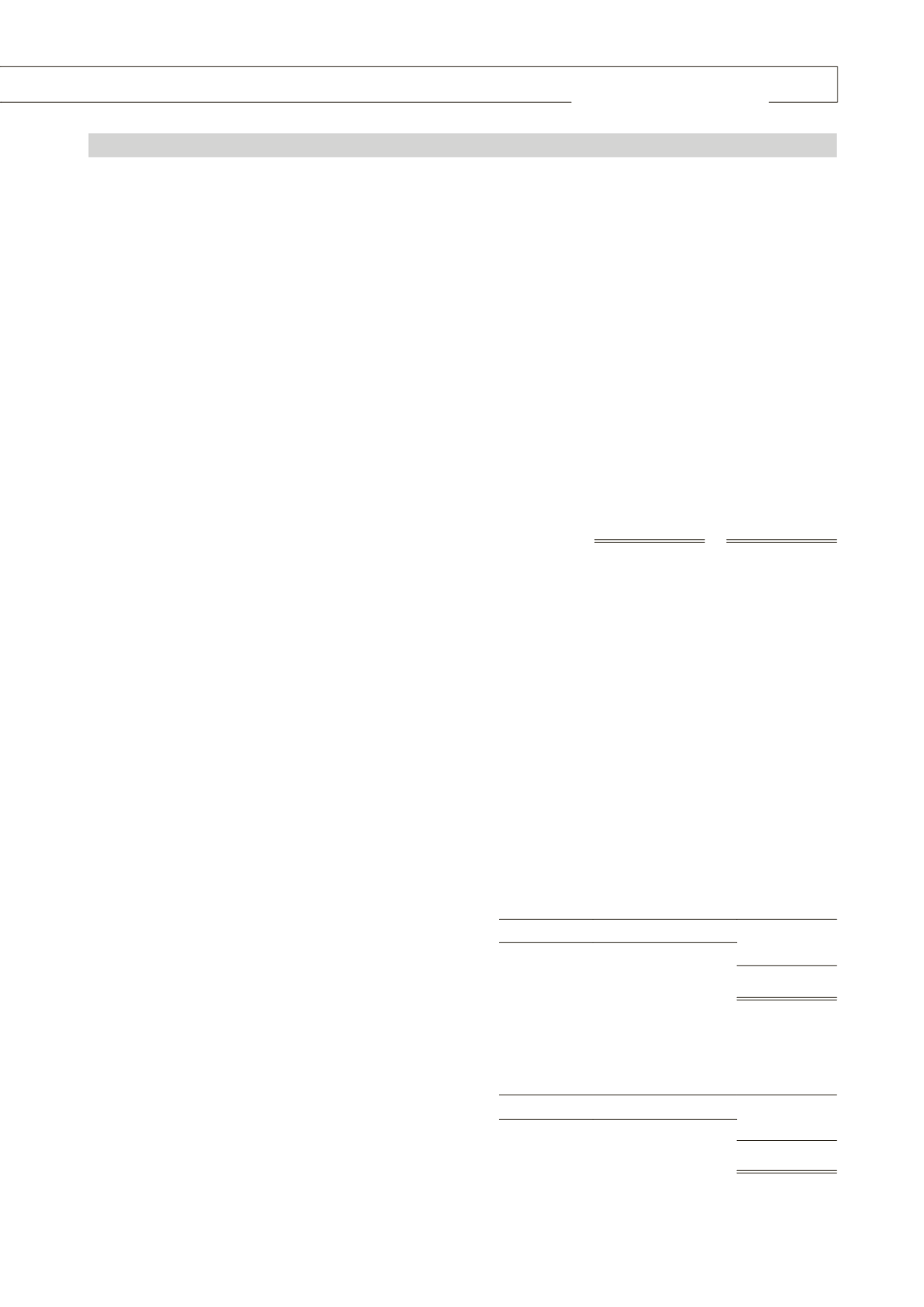

33. FINANCIAL INSTRUMENTS

Classification of financial instruments

Note

Loans and

receivables

$’000

Financial

liabilities at

amortised cost

$’000

Total

$’000

Group

2016

Assets

Receivables

15

2,175

–

2,175

Trade and other receivables

17

52,883

–

52,883

Cash and cash equivalents

18

24,967

–

24,967

Total financial assets

80,025

–

80,025

Total non-financial assets

118,067

Total assets

198,092

Liabilities

Trade and other payables

19

–

(32,275)

(32,275)

Finance lease payable

20

–

(514)

(514)

Bank borrowings

21

–

(43,573)

(43,573)

Total financial liabilities

–

(76,362)

(76,362)

Total non-financial liabilities

(8,356)

Total liabilities

(84,718)