29

MTQ CORPORATION LIMITED

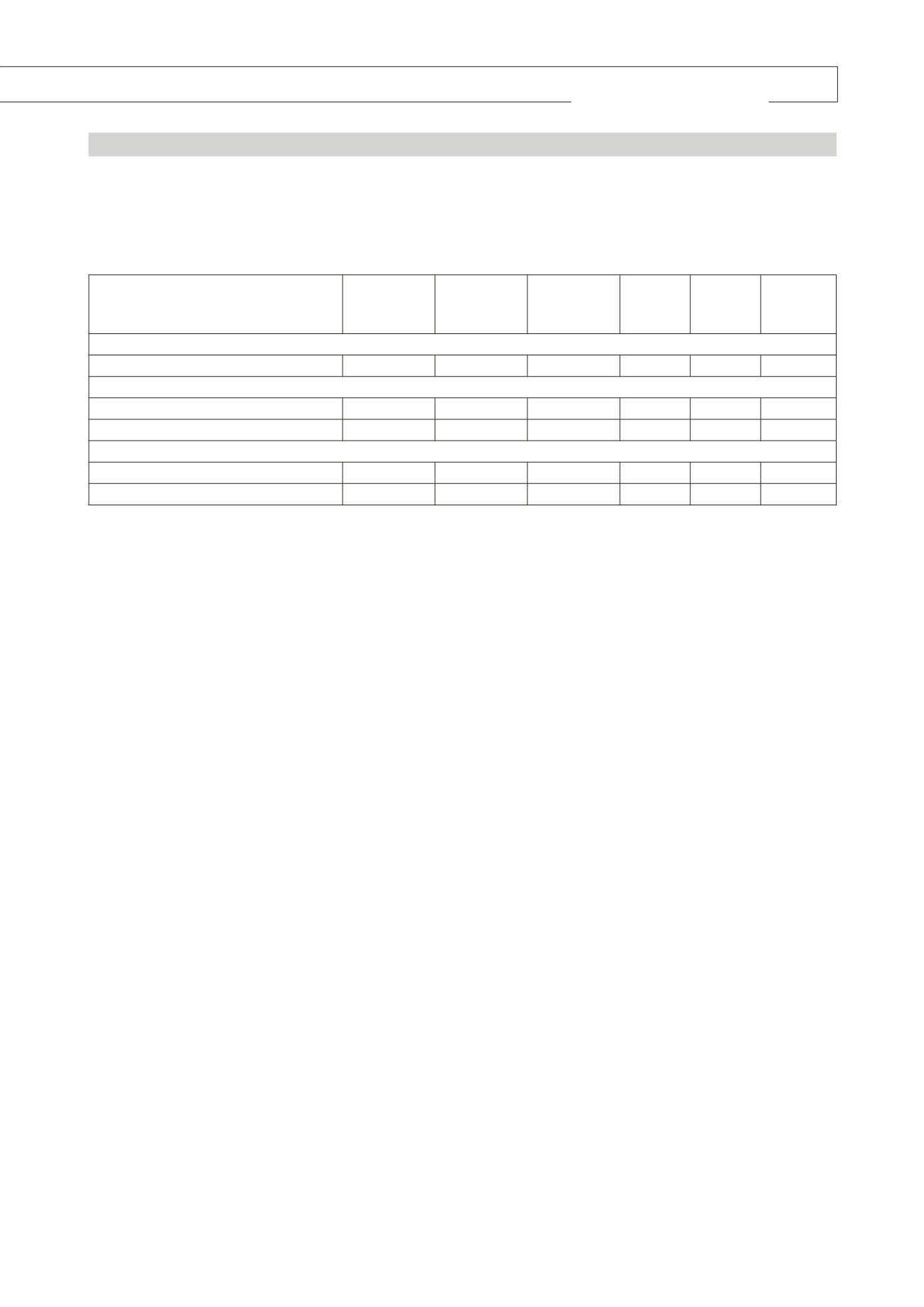

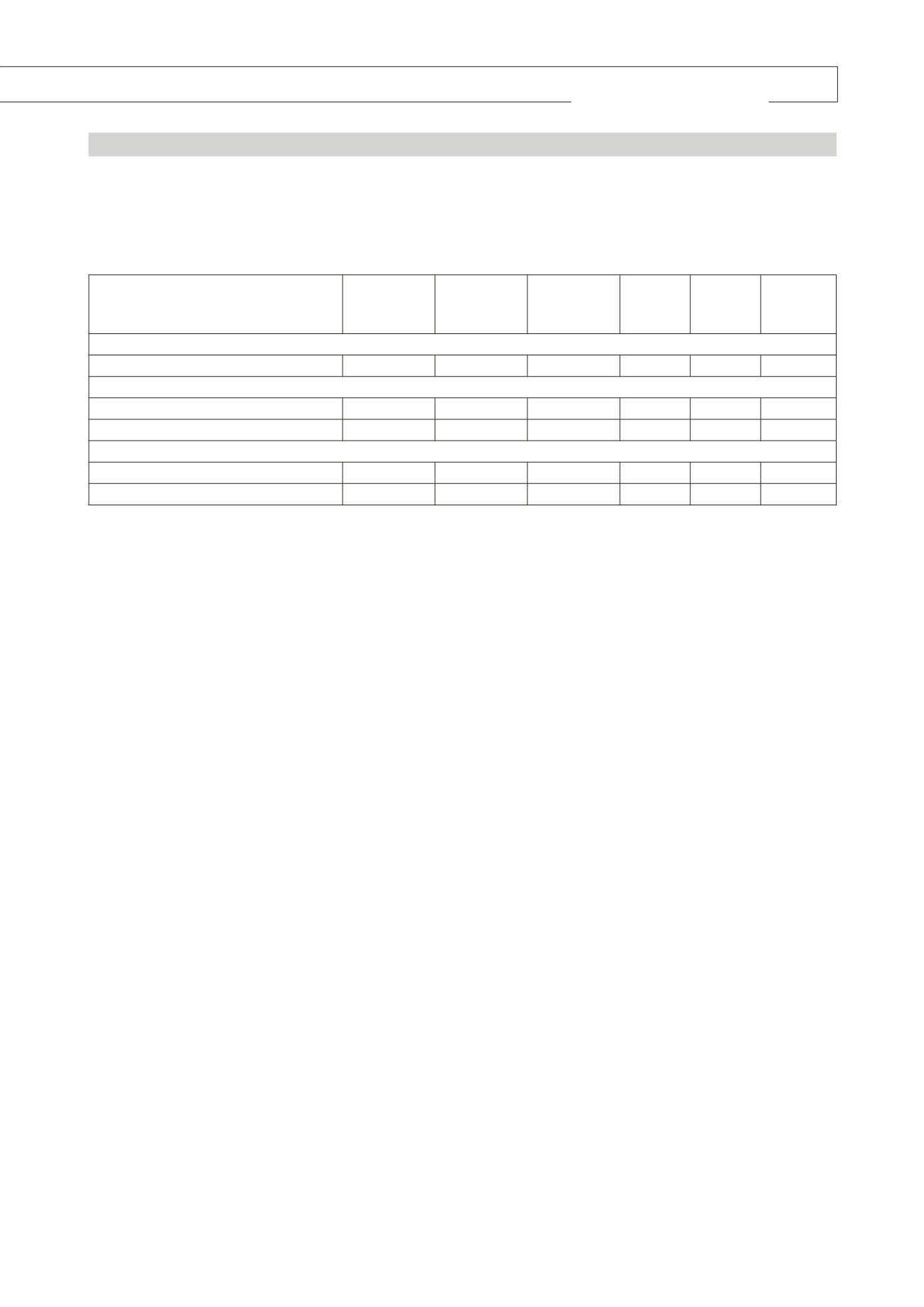

The remunerations of the top 5 key executives (who are not directors) of the Group are as follows:

Name of Key Executive

Fixed

Component

1

(S$’000)

Variable

Component

²

(S$’000)

MTQ Share

Plan

3

(S$’000)

Provident

Fund

5

(S$’000)

Benefits

6

(S$’000)

Total

(S$’000)

Between S$1,000,001 and S$1,250,000

Robin King

563

229

158

79

42

1,071

Between S$500,001 and S$750,000

Vincent Allegre

415

84

57

50

31

637

Sumardi Bin Sidi

178

353

10

11

14

566

Between S$250,001 and S$500,000

Ian Robert Hortin

186

70

9

14

194

473

Dominic Siu Man Kit

256

53

27

11

33

380

1

Fixed Component refers to base salary and Annual Wage Supplement paid during the financial year ended 31 March 2016.

² Variable Component refers to cash bonuses awarded for financial years ended 31 March 2014 and 2015’s performance paid out during the financial

year ended 31 March 2016.

³ The figures are based on the grant date fair values of the tranches of Awards vested and released during the financial year ended

31 March 2016. Further information on the MTQ share Plan is set out in the Directors’ Statement section.

4

Provident Fund represents payments in respect of statutory contributions to national pension schemes.

5

Benefits are stated on the basis of direct costs, and include car benefits, other benefits associated with relocation and other non-cash benefits such as

club membership.

The total amount paid to the top 5 executives during the financial year ended 31 March 2016 is S$3.1 million.

Other than Mr. Kuah Kok Kim, and Mr. Kuah Boon Wee, no employee of the Company and its subsidiaries was an

immediate family member of a Director or the Group CEO and whose remuneration exceeded S$50,000 during the

financial year ended 31 March 2016.

ACCOUNTABILITY AND AUDIT

Principle 10 : Accountability

Management provides monthly management accounts, complete with relevant analysis and commentaries of the

performance, to the Board on a timely basis. Board reports, including financial information and annual budget, significant

corporate issues and management proposals requiring the approval of the Board, are circulated to all Directors prior to

the Board meetings.

The Board reviews legislative and regulatory compliance reports from the management to ensure the Group complies with

the relevant requirements. In line with the Listing Rules of SGX-ST, the Board provides a negative assurance statement to

the shareholders in its quarterly financial statements announcements, confirming to the best of its knowledge that nothing

had come to the attention of the Board which might render the financial statements false or misleading in any material

aspect. For the financial year under review, the Group CEO and Group CFO have provided assurance to the Board on the

integrity of the Group’s financial statements and the adequacy and effectiveness of the Group’s risk management and

internal controls systems.

Shareholders are informed of the Group’s quarterly and full year financial reports and other various disclosures of corporate

developments in a timely manner through the announcements made to SGX-ST via SGXNET.

CORPORATE

GOVERNANCE REPORT