Investor Relations - Financials

Investor Relations - Financials

Unaudited Condensed Interim Financial Statements For The Six-Month Financial Period Ended 30 September 2024

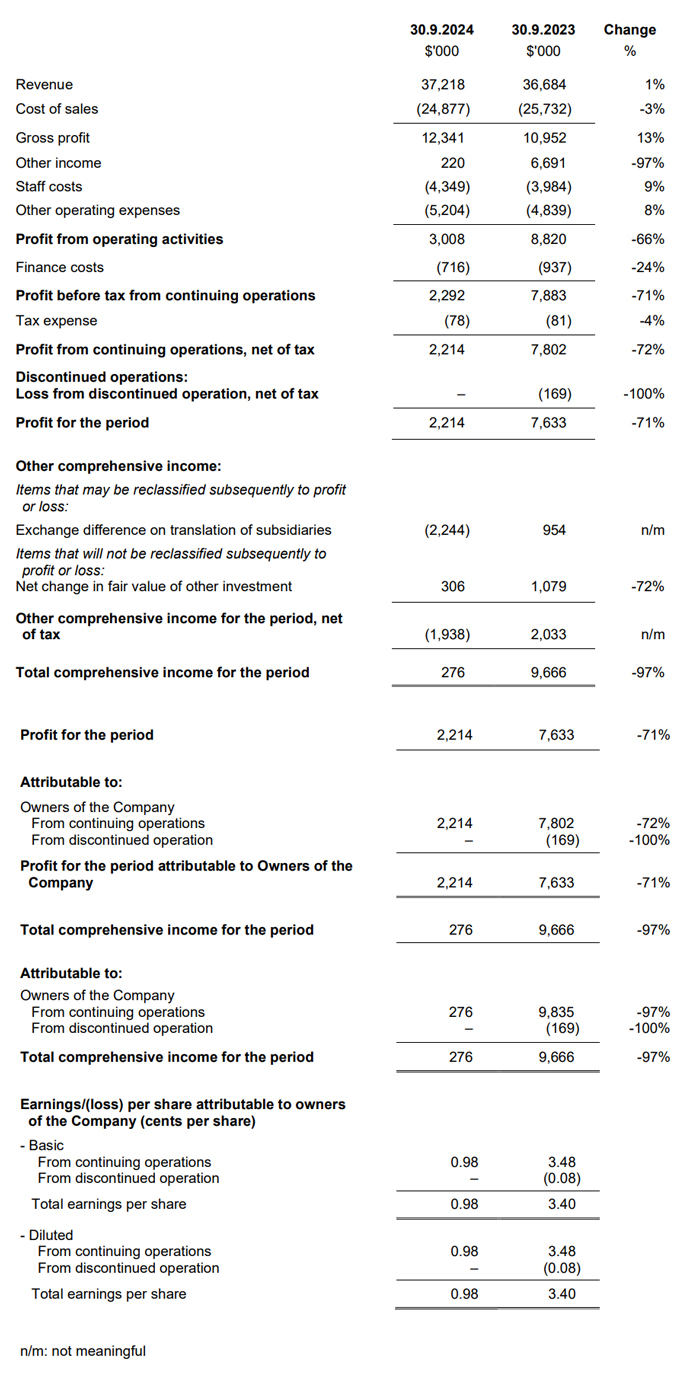

Financials ArchiveCondensed interim consolidated statement of comprehensive income

For the six-month financial period ended 30 September 2024

(In Singapore dollars)

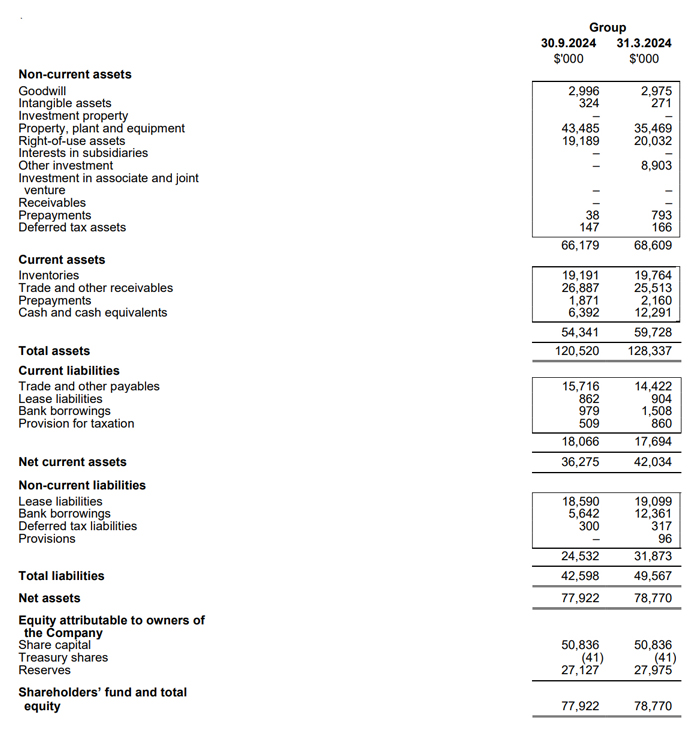

Condensed interim balance sheets As at 30 September 2024

(In Singapore dollars)

REVIEW OF PERFORMANCE OF THE GROUP

Condensed Interim Balance Sheets

The changes in Balance Sheets were mainly due to:

- increase in property, plant and equipment of S$8,016,000;

- decrease in Other Investment by S$8,903,000; and

- decrease in bank borrowings.

Apart from the above, movements in working capital items were mainly due to timing differences.

Condensed Interim Consolidated Cash Flow Statement

Cash-wise, the Group generated a net cash inflows of S$2.6 million from operations in 1HFY2025. Investing cash flows included approximately S$7.9 million in capital expenditure related to the Group’s expansion into the UAE, which was largely offset by the net proceeds of S$9.2 million from the disposal of the remaining MMA Shares, as previously announced. Within the financing activities, the Group voluntarily pared S$6.5 million of its revolving bank facilities during the period to lower interest expenses. Overall, the Group had cash and cash equivalents of S$6.4 million as at 30 September 2024 (31 March 2024: S$12.3 million), after paying out FY2024's final dividend of S$1.1 million in August 2024.

Condensed Interim Consolidated Statement of Comprehensive Income

The Group reported S$37.2 million revenue for 1HFY2025, an increase of 1% year-on-year ("YOY") compared to S$36.7 million in 1HFY2024, driven primarily by Singapore's strong performance. Revenue in Singapore grew 25% to S$20.8 million, supported by improved execution and turnaround of key projects. Bahrain's revenue saw a slow start but has since stabilized, with the long-term outlook remaining positive. Gross profit margins improved to 33.2% with higher utilization and better job mix.

During the period, the Group experienced a foreign exchange loss of approximately S$0.5 million, which is largely unrealized, due to recent USD fluctuations and impacted the total Other Operating Expenses (OOE). Excluding this FX loss, the Group's OOE would have been S$4.7 million, a decrease of about 6% from 1HFY24, mainly due to the absence of costs related to Pandan Property and relocation in the prior year. Staff costs increased in line with higher revenue while finance costs decreased due to lower borrowings during the period.

The Group achieved a profit before tax of S$2.3 million in 1HFY2025, an increase of 51% YOY excluding the one-off gain on disposal of Pandan Property recognized a year ago.

Commentary

The Group is pleased to deliver another profitable period, driven primarily by the strong performance in Singapore. Bahrain has picked up after a slow start and the Group remains cautiously optimistic that this momentum will continue through the second half of the year, contributing to overall growth.

The expansion into the UAE is progressing well, with construction on track for completion in 2025. The Group has initiated the manpower hiring process and are actively engaging with key principals to ensure operations commence smoothly upon completion of the facility.

Looking ahead, the Group remains focused on strengthening our presence in existing markets while exploring opportunities in new regions.